Switching from

Asurion to AKKO

If you’ve been trying to cancel Asurion phone insurance for an alternative that fits your needs better, you may have found that the process is more complex than you expected. Unfortunately, many device protection companies do this on purpose in order to retain clients out of sheer convenience.

You shouldn’t have to muddle through a confusing cancellation process to make the switch to an Asurion phone insurance alternative. We’ve cleared the air around switching from Asurion insurance to AKKO so that you can make the change with ease.

Quick Links: Benefits of AKKO | How to Cancel Asurion | Sign Up for AKKO

Looking for an

Asurion Alternative?

You’re not alone—many consumers have made the decision to cancel Asurion insurance for a variety of reasons.

Asurion does cover many common phone issues, and new phone users can easily add Asurion onto their phone bill through many major carriers.

However, AKKO insurance tends to offer better value for most — if not all — cell phone users. With AKKO, you can easily bundle insurance for the whole family at a low monthly rate. Plus, AKKO phone protection covers a wide variety of issues, including theft, damage, loss, and mechanical breakdowns.

Phone-only Protection

Price

$6 - $12

/month

Covers

Covers Accidental Damage

Mechanical Breakdowns

Theft

Used or refurbished devices

Deductibles

Damage

$29 - $99

Theft/Replacement

$75 - $100

# of Claims Allowed

Unlimited

Squaretrade

Monthly Insurance

Price

Based on your carrier, see Sprint (T-Mobile), AT&T, and Verizon.

Covers

Covers Accidental Damage

Mechanical Breakdowns

Theft

Must be refurbished by Asurion

Deductibles

Damage

Based on your carrier, see Sprint (T-Mobile), AT&T, and Verizon.

Theft/Replacement

Based on your carrier, see Sprint (T-Mobile), AT&T, and Verizon.

# of Claims Allowed

Based on your carrier, see Sprint (T-Mobile), AT&T, and Verizon.

Phone-only Protection

Asurion

Monthly Insurance

Price | $6 – $12/month | |

|---|---|---|

Accidental Damage | ✓ | ✓ |

Mechanical Breakdowns | ✓ | ✓ |

Theft | ✓ | ✓ |

Used or refurbished devices | ✓ | Must be refurbished by Asurion |

Deductibles (Damage) | $29 – $99 | |

Deductibles (Theft/Replacement) | $75 – $100 | |

# of Claims Allowed | Unlimited |

Benefits

Benefits of AKKO Phone Insurance

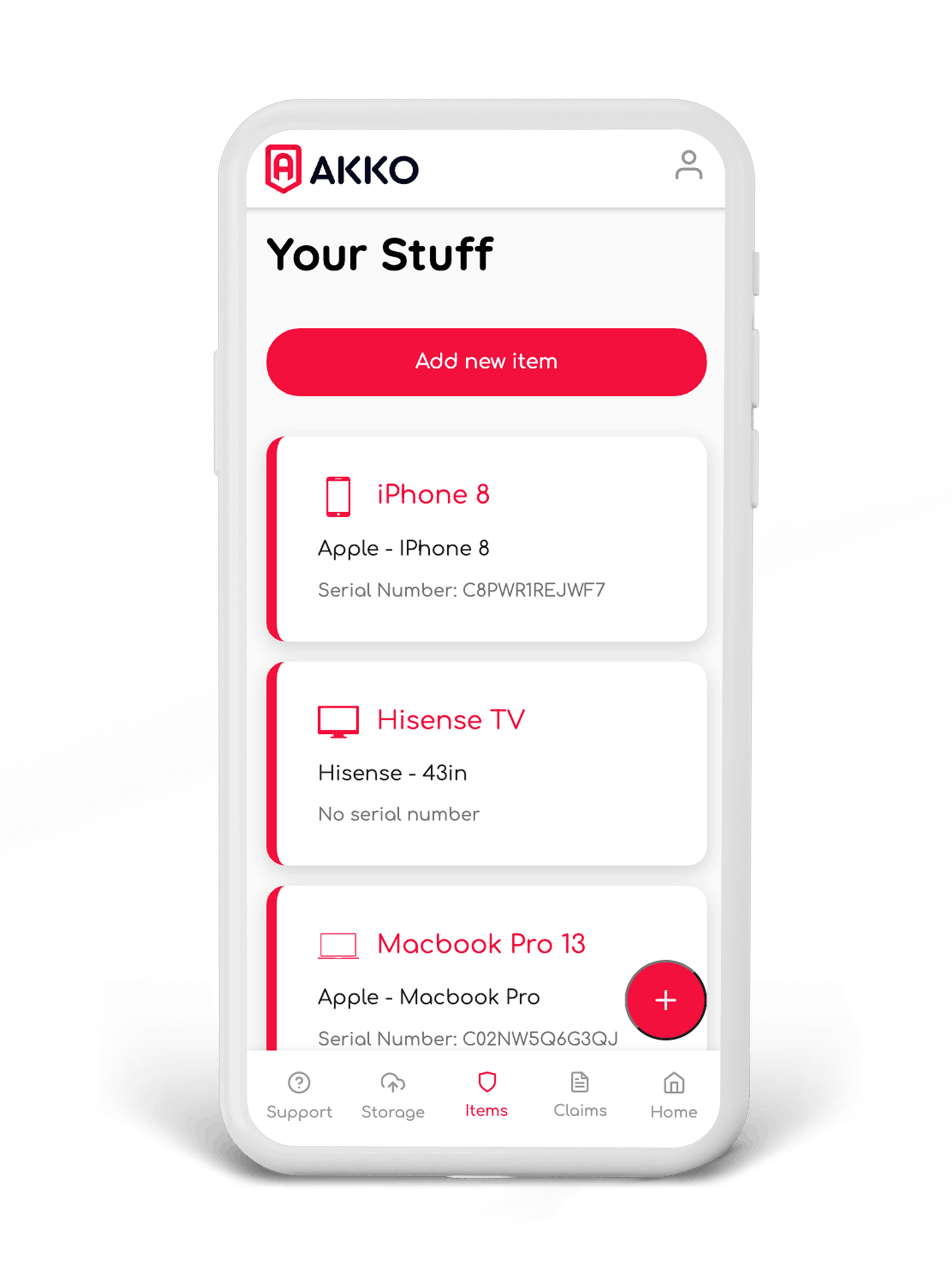

Our customers love the freedom that they feel with AKKO’s affordable and inclusive phone protection plans. Ready to learn more about this popular Asurion phone insurance alternative?

With AKKO, you can expect:

- Insurance for new, used, and refurbished devices

- Unlimited claim filing

- Lower costs across the board

Here’s a bit more information about each of these distinct benefits.

01

Theft

A stolen phone isn’t only a massive inconvenience and a potential security threat; replacing it can also be an expensive hassle. Unfortunately, Asurion (and many other phone protection companies) don’t offer theft insurance within their plans.

At AKKO, we understand that theft happens. That’s why we include theft in our list of insurable situations, along with loss, damage, and internal issues.

02

Number of Claims Allowed

Many phone insurance providers only allow one or two claims per year. Whether you have multiple phones on a bundle plan or only a single device insured with AKKO, we understand that accidents happen! When you cover your devices with AKKO, you can file unlimited claims.

03

Pricing

Since Asurion is a warranty provider, users pay a fee upfront for one or two years of service. Not only is it more convenient to pay monthly with AKKO, but it actually ends up being cheaper each month for the same amount of coverage time.

With an AKKO insurance plan, you could end up paying a monthly fee as low as $5.

04

Deductibles (Theft/Replacement)

Deductibles are often the highest cost when it comes to cell phone insurance. If your phone protection company charges a low coverage rate, but has high deductibles, the low rate isn’t even worth it!

AKKO offers both low coverage rates and low deductibles, as well as consistent coverage for theft and replacement, which Asurion protection plans don’t always include.

A Step-by-Step Guide

How to Cancel

Asurion

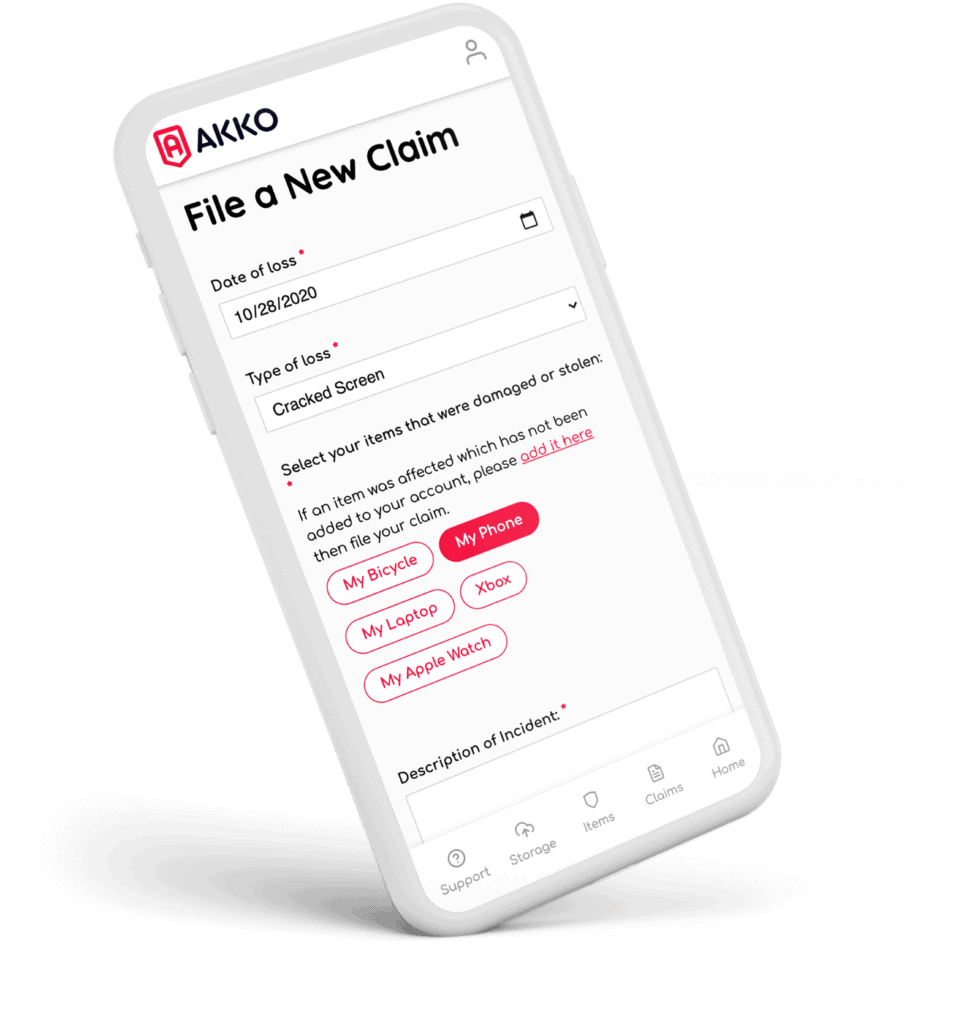

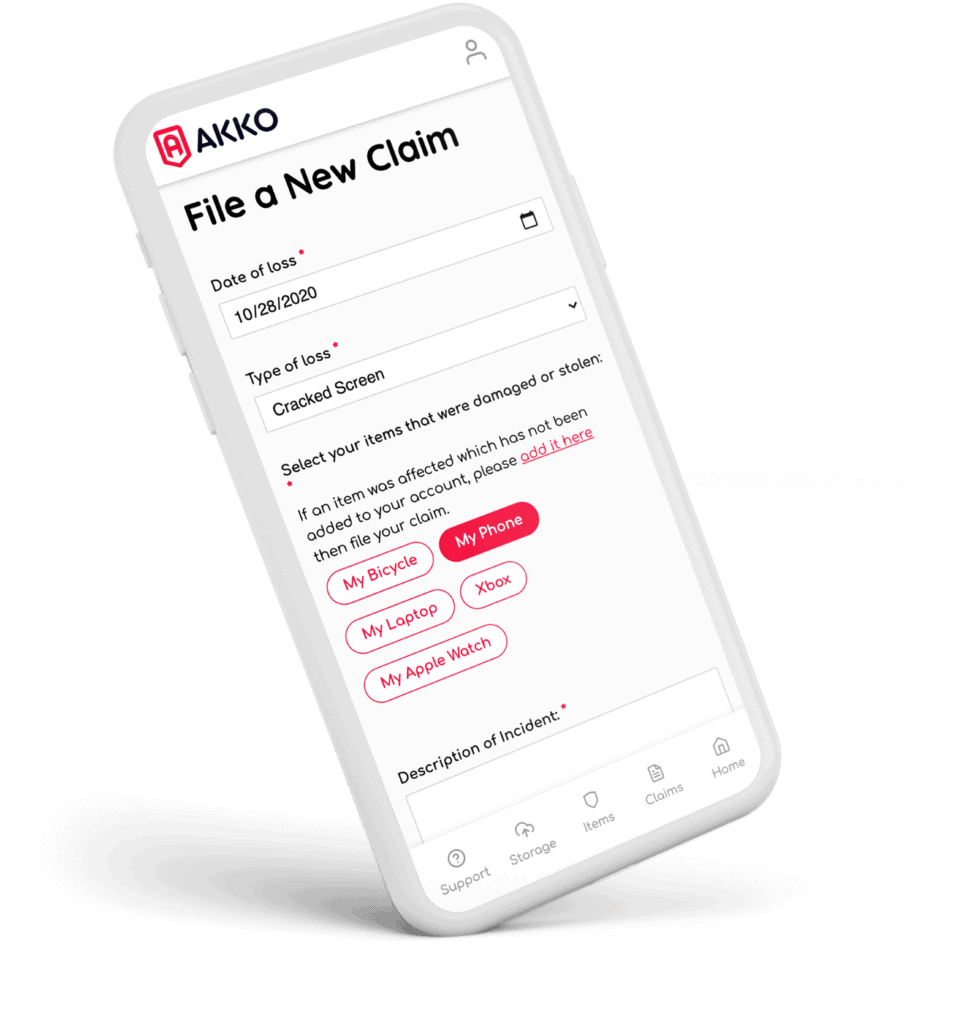

Switching from Asurion insurance to an AKKO plan doesn’t have to be complicated. In order to cancel Asurion phone insurance, take a moment to find out when your current insurance will run out. You can find this information by calling Asurion customer service or logging into your online account with your cell service provider.

Once you’re ready to cancel, call the Asurion customer service line for your specific service provider. You can find this information directly on the Asurion website on the Contact Us page.

The representative you speak with should be able to cancel your warranty during your call once they receive the personal information about your account that they need.

After confirming your cancellation with an Asurion customer service representative, make sure to check your next bill to confirm that coverage has been cancelled. If you prefer to write in a cancellation notice instead, you can find the address to send it to on the terms and conditions of your warranty or your original receipt.

Can I Get a Refund

If I Cancel Asurion?

Asurion does not typically issue full refunds once the warranty has been put into effect. However, you can receive a prorated refund for any unused coverage that was left over after cancellation.

Check your credit card statement after cancelling to make sure your prorated refund begins on the day that you cancelled. Asurion does not make customers wait until the next billing cycle to be completely free of coverage.

Disclaimer: The following content applies to Asurion Customers who have purchased phone protection plans through asurion.com. If you purchased an Asurion Plan through your carrier then please see our Switch Page to locate your carrier and find the correct instructions.

Enjoy Insurance You Can Trust with AKKO Plans

It’s time to cancel Asurion insurance and get the coverage you deserve. Pay less and enjoy more coverage and greater freedom with AKKO phone insurance.